If you are expecting a miracle from Davos Switzerland, think again. All we are seeing is bread and circuses

while Putin tells Michael Dell to basically shove it and other

countries using the economic forum to dish out political discourse. The

last post discussing the paradox of thrift generated a lot of commentary

on both sides. I am still stunned at how many people actually still

believe that we live in a purely free-market capitalistic system. We do

not. Many people simply assume that the Federal Reserve System because

it has the word “Federal” means that it is owned by the people, it is

not. The Federal Reserve also known as the Fed is the central bank of

the United States and has been a key partner in this global credit

crisis. The Fed was brought to our country in 1913 by the Federal

Reserve Act. The Fed is a quasi-public entity with private components.

This may stun many people since many think that the Fed is completely

independent from the banking powers of the country but it is not. Yet

the way they interact with our government, it gives the impression that

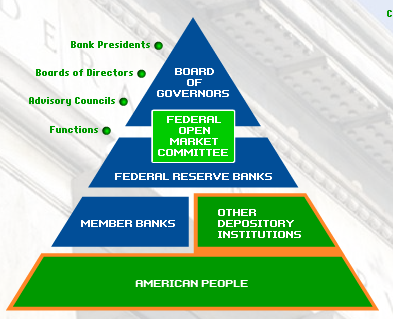

they are fully part of the government. The Fed breaks down as follows:

(1) Board of Governors in Washington D.C.

(2) Federal Open Market Committee

(3) 12 regional Federal Reserve Banks

(4) Numerous U.S. private banks

(5) Advisory Councils

The Fed in many regards has failed in its mission and with Ben Bernanke

telling us he is willing to drop dollars from “helicopters” we must

gear up for inflation down the road. That is another point I want to

bring up. In a fiat regime, inflation or deflation is a matter of

policy will. That is, the Fed always has tried to keep inflation at a

moderate level purposefully and has successfully done so since the Great Depression.

Yet now, it is having a harder time with rates reaching the zero bound

and may have to resort to literally dropping money from helicopters.

I love this graphic from the Federal Reserve’s own website on Fed

101. It pretty much sums up the structure of our banking system (guess

who’s on the bottom?):

So if you are wondering why some banks seem to have more lives than

others, only 38 percent of the 8,039 commercial banks in the United

States are part of the Federal Reserve System.

Don’t think that the Fed came into being on easy street. With the

Panic of 1907, the stage was set for the money trusts in the big Eastern

cities to push for a centralized bank yet progressives fought against

this plan. You also have to go back to the time and general sentiment

was rising for a central bank amongst the public. Yet the public

doesn’t always get it right and all we need to look at is Real Homes of Genius and Option ARMs to realize the public can be wrong many times as well.

The Federal Reserve Act was signed on December 23, 1913 only a few

days before Christmas which was perfect timing to jam something through

Congress. Now you have to wonder about the timing and history many

times tries to make it seem that it was a bill that was passed with

support from the public and flew right through politically. It did not,

this was years in the making and frankly, it is hard to say how many

politicians really understood that they have signed over the keys to the

country to the Lords of Creation.

Now you may be thinking this is all a bit far fetched but keep in

mind I am getting this research from the Fed itself! And if you have

any doubt who has the power right now, it looks like the Eastern money

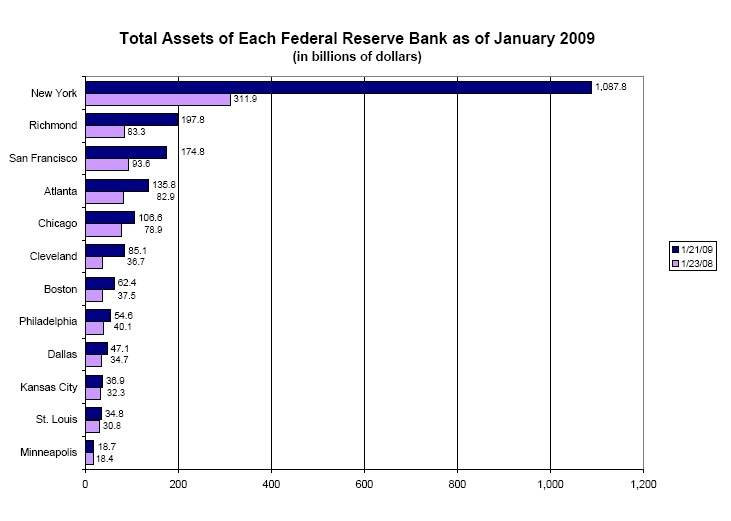

trust is back in the game once again:

I’m not sure there is a clearer picture of who is getting the most

action since the crisis has taken place. The New York Fed has seen the

most action out of the 12 Regional Banks and the amount of “assets” they

have on their books have shot up over $1 trillion. Many people think

that only $350 billion has been shoveled off via TARP part 1

but that is separate and distinct since that was money issued via

capital injections by the U.S. Treasury. Most of these assets are toxic

collateral exchanged to member banks for U.S. Treasuries via the Fed to

keep them living one more day and waiting for the government to decide

how they are going to unload decades of waste onto the public.

Keep in mind much of the TARP is issued through preferred shares,

which almost work as loans to participating organizations. In a way,

the system is now setup that we may screw ourselves since we are part of

the game. For example, Bank of America already has $45 billion of the TARP funds. This is flat out nuts! Bank of America’s current market cap is only $42 billion:

The above is one part of the problem regarding lending to the public

since the preferred shares really don’t do anything to encourage

lending. Capital ratios are so horrible at banks that the notion was

that the U.S. Treasury would simply buy preferred shares and the market

would suddenly bounce back and the shares would be paid back. Consider

it a really cheap loan to the banks on the backs of American taxpayers.

Yet the market didn’t bounce back and now the shares are there as

simply another liability to the banks. So the idea that many of these

banks are free and clear is absurd. The public already is knee deep in

this stuff. We own a piece of these already whether we want to or not

which is unfortunate. That is why people arguing against us getting

involved don’t even realize that we are completely involved through TARP,

Fed purchase agreements, and the fact that our discount rate is near 0

percent punishing conservative savers who don’t want to play the stock

market casino.

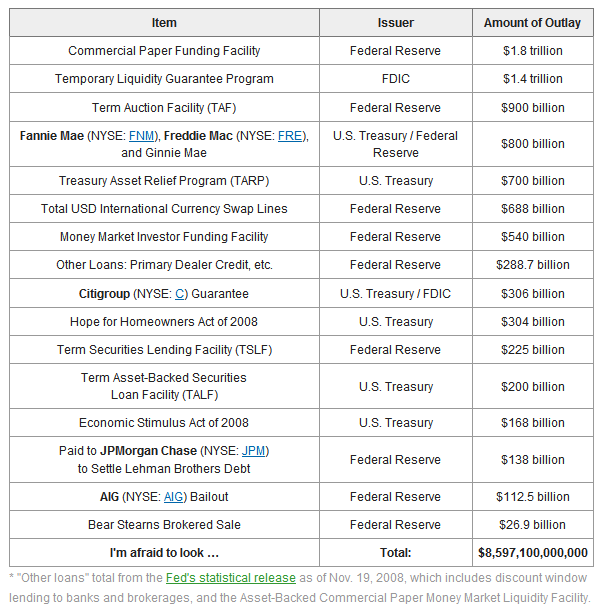

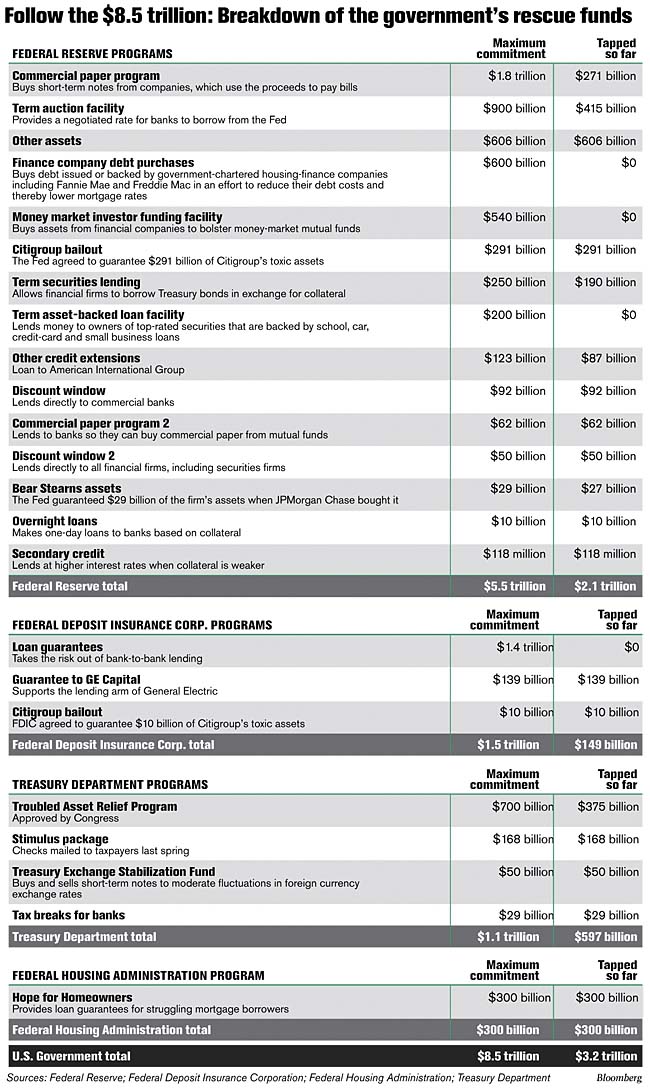

If you want to see how much money is on the table already, take a look at this chart put out back in November of 2008 by the Motley Fool:

Let us go through the list above and you can see that simply focusing on the $350 billion already allocated by the TARP

is chump change to what is riding on this game. We saw in the most

recent chart above with the 12 Regional Banks that the Fed already has a

ton of questionable assets on its books. Let us look at the term

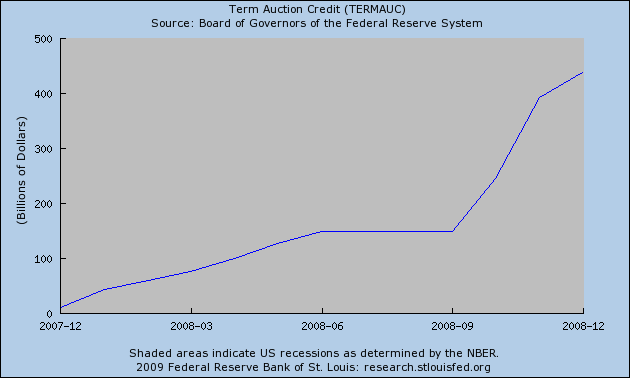

auction mechanism since the crisis started:

The Fed can go up to $900 billion and we are already at $438 billion,

a size much larger than the TARP but many people don’t seem to be

paying attention to even this program of many. Even looking at the

list, that $168 billion Wal-Mart tax rebate voucher from the first half of 2008 now seems like a conservative outlay in the face of what we are now talking about.

And just look at how much was guaranteed to Citigroup. We now

backstop $306 billion of their questionable loans through a combination

of the U.S. Treasury and FDIC. That is insane for one institution! The

amount to AIG? It just keeps growing as time goes on. And we have

already tapped well above $3.2 trillion:

The reason I even uttered the word nationalization in the previous

article is that we are already spending money in the trillions whether

people realize it or not and we are committed to a much larger amount.

No one has really run an analysis showing that nationalization would

cost “X” dollars instead of the currently committed $8.5 trillion which

seems to be growing as days go by. And don’t think I’m married to this

one idea alone. It is simply better than these multiple clandestine

nationalization-lite strategies that we are currently employing. Aside

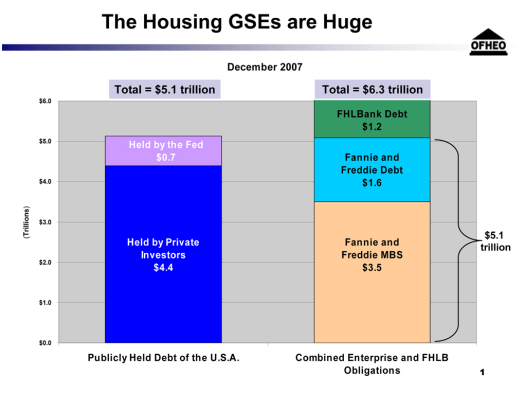

from semantics, we already nationalized Fannie Mae and Freddie Mac

and they are the primary mortgage players in this country. AIG is

virtually nationalized. If you think the amount on the books of Fannie

Mae and Freddie Mac is small think again:

Keep in mind the chart above doesn’t include 2008 which saw a jump because Fannie Mae and Freddie Mac

were virtually the only game in town. And now with “prime” loans going

bad in record numbers, we are on the hook for enormous losses.

The problem I have with the current structure is the U.S. taxpayer is

already committed to trillions of downside with very little upside

potential. Long time readers know that my stance has always been for

the government to stay out of the markets especially when it came to

housing prices. Yet one thing I despise even more is using taxpayer

money to bailout Wall Street and banks under the umbrella that it is

help for the Main Street family. They got their goodies first and now

after such a boondoggle, they may want to throw a bone to the public

since the masses are getting agitated. In fact, the irony with the TARP

funds is they are getting a cheap loan on your back and if things get

better, they pay it off and never are held responsible for their

actions. What do you get? A pathetically low return if you are lucky

to even see the money ever again.

That is the fundamentally troubling sign of the current structure.

We are now faced with the option of bringing in say Bank of America or

Citigroup that we have billions in preferred shares in these places. Do

we wipe ourselves out since we already have billions in them? Talk

about a conflict of interest but I think that was the entire purpose of

this. Banks knew we would now be committed to the cause since our money

is at stake. But is it really? Most people didn’t even want TARP but it was rammed down our throats and look what it has done. Nothing.

So here are the options that we have on our plate:

(a) Continue with TARP and the current litany of programs.

-pro: Nothing that I can see. The market improves, banks get away

with decades of malfeasance, and taxpayers simply get their money back.

-con: Many things. We are getting screwed on a continued basis and

for those who say “stay out” it is already too late. Look at the data.

The horse is out of the barn.

(b) Go with the Bad Bank.

-pro: Banks have the chance to unload toxic assets and improve their

balance sheets. This will increase lending but by how much?

-con: Taxpayers get royally screwed here because we’ll get the worst

of the worst. This is already happening (heck, we nationalized Fannie

Mae and Freddie Mac, AIG – it isn’t like we nationalized Netflix which

is actually doing well). We will have years and years of crap to work

through and it isn’t clear how banks will be punished and how we will

prevent this from ever happening again.

(c) Nationalize

-pro: We own the bank and can wipe out common shareholders,

preferred (yes, even us but we already own it anyway), and eliminate

management. We tier and spin off the good, the bad, and the ugly on a

temporary basis.

-con: It will cost us a lot but everything else is already costing a

lot. But the question is, will it cost us more than the above

options? Not sure. But look at the Federal Reserve and its

quasi-public setup. You cannot serve two masters at once and that is

what it is trying to do. Clearly, their number one master right now is

Wall Street and the money elite. You need only look at the regional

bank assets above. Take a look at the FDIC failed bank list and it will

tell you who is connected and who is not.

(d) Do nothing

-I’m stunned some people still believe this is an option still. I

didn’t realize $3.2 trillion is doing nothing. Something is already

done and it is too late to do nothing since everything is fluid right

now and politically how things go, it is now a question what is the best

road to travel of the many crappy pothole filled paths.

I always pushed for a hands off approach because if you look at

history, anytime we get involved things normally get worse or fly off a

cliff. That is just the way things go. But what is worse is many

people are snowed into thinking nothing is being done currently. It

is. How’s that working for your paycheck? Try getting a loan right

now. Do you think you have the same access to the Fed and U.S. Treasury

as the connected banks? And don’t fall for the argument that they

“know what they are doing” because clearly they do not. You need only

look at the CDO, CDS, TARP, ABCP, and every other alphabet soup of junk

floating out there to realize things are not going well.

Fundamental changes are coming. I only hope that we look deeply at

the structure of the Fed and reexamine whether they deserve the power

they currently have. Just look at a brief list of current primary

dealers with the Fed: